oklahoma franchise tax instructions

Add the credits from each states Schedule S line 12 and. The taxpayer owes an additional 5 14 use tax.

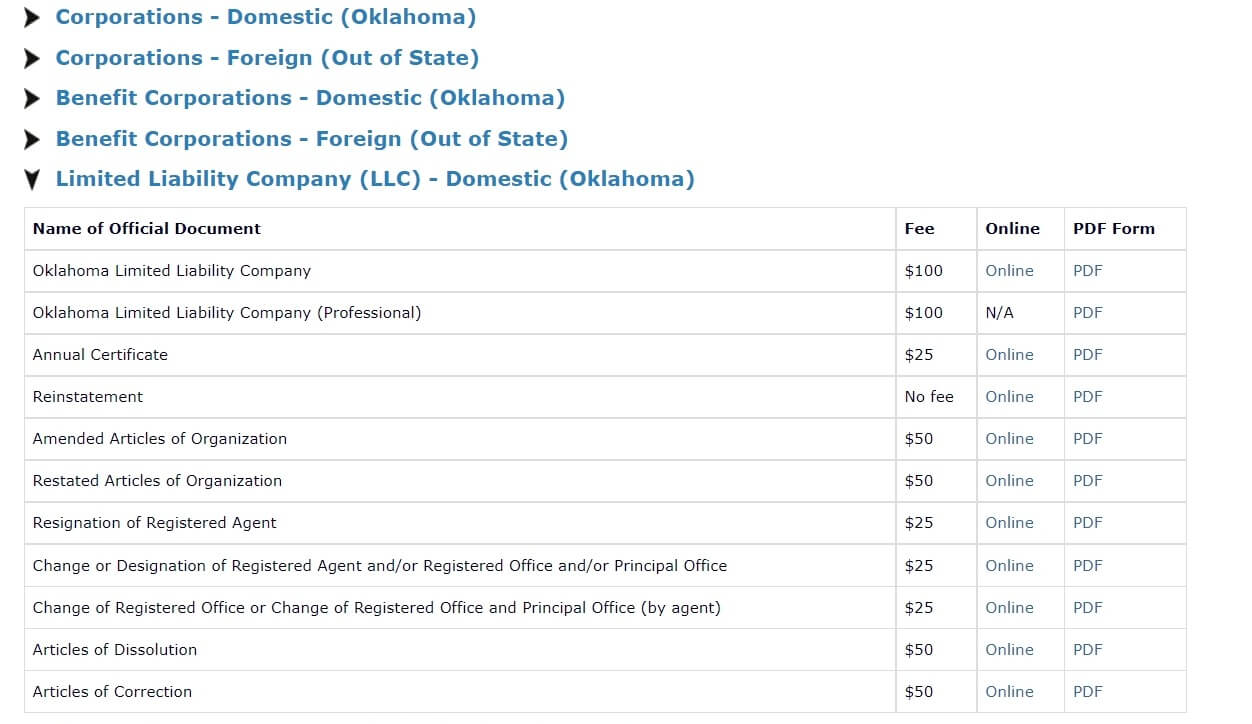

Oklahoma Llc Annual Report File An Llc Annual Report In Oklahoma

Gross Production Lease Records.

. Oklahoma reduced its corporate income tax rate from 6 to 4 percent tying Missouri for the second-lowest rate in the nation. Gross Production 405 521-3251. These are the official PDF files published by the State of California Franchise Tax Board we do not alter them in any way.

In the table below you will find the income tax return due dates by state for the 2021 tax year. Schedule C Instructions PDF may be helpful in filling out this form. Instructions plus a related application form.

California LLCs are free until June 2023 800 20. These related forms may also be needed with the Florida Form F-1120. TaxFormFinder provides printable PDF copies of 175 current Pennsylvania income tax forms.

Basics of the Franchise Disclosure Document FDD Creating a Business Plan for Your Franchise. Account Maintenance 405 521-4271. HR Block Emerald Prepaid Mastercard is issued by MetaBank NA Member FDIC pursuant to license by.

TaxFormFinder has an additional 40 Florida income tax forms that you may need plus all federal income tax forms. The Cost to Start a Franchise and Financing Options. The PDF file format allows you to safely print fill in and mail in your 2021 California tax forms.

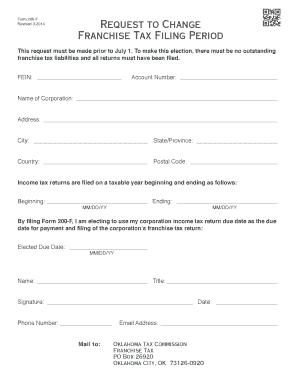

Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. If you would like to add or change a Legal name in the Oklahoma Tax Commission fill out Packet A and mail to. 2021 HRB Tax Group Inc.

This third-party individual or business entity acts as a point of contact on behalf of the business and receives things like tax forms and legal documents government correspondences and notices of a lawsuit. If you have questions you can contact the Franchise Tax Boards tax help line at 1-800-852-5711 or the automated tax service line at 1-800-338-0505. The taxpayer then brings the typewriter into Galveston.

Each calendar year the state income tax due date may differ from the Regular Due Date because of a state. Choosing the Most Profitable Franchise for You. AR Secretary of State Franchise Tax Report.

This document contains the official instructions for filling out your California Form 540540A. You can print other Florida tax forms here. On July 1 2006 a Texas taxpayer goes into Oklahoma and buys a typewriter for personal use and pays 3 Oklahoma sales tax.

HRB Maine License No. Oklahoma Department of Commerce wwwokcommmercegov 405-815-5218 405-815-6552. Census Bureau 2020 Annual Survey of State Government Finances Tables https.

Related Florida Corporate Income Tax Forms. Acquired by the nature of all organizations falling within the purview of the Franchise Tax Code. 5 month window surrounding anniversary month.

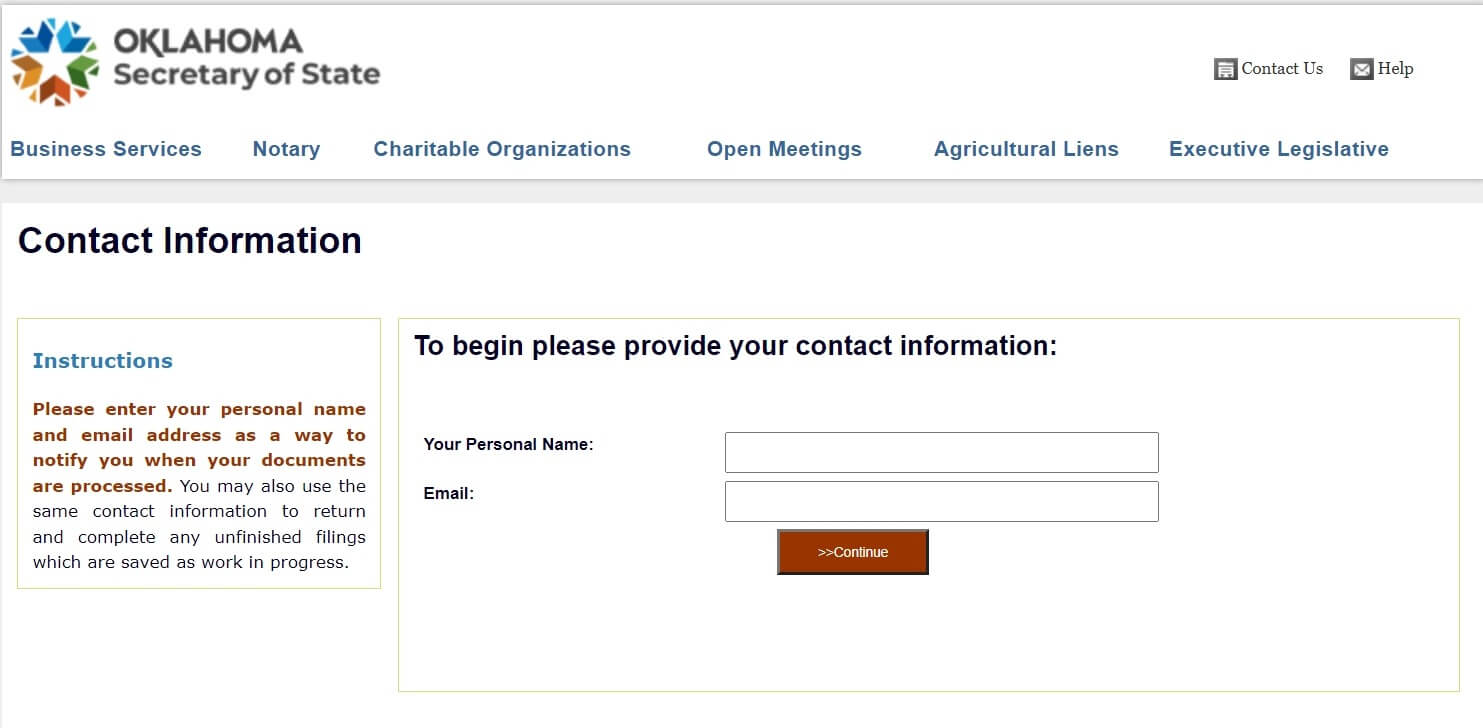

Paying your annual tax Online Bank account Web Pay Credit card Mail Franchise Tax Board. You must submit proof of the LLCs timely amended return or claim for refund for the tax year selected in STEP 2 AND proof that the LLC paid the LLC Fee for that year. To make this election file Form 200-F.

Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Corporations that remitted the maximum amount of franchise tax for the preceding tax year or have had their corporate charter suspended do not qualify to file a combined income and franchise tax return. Minnesota has a state income tax that ranges between 535 and 985 which is administered by the Minnesota Department of Revenue.

The tax due on the preceding tax years return if the individual filed a tax return for the preceding year and the year was a taxable year of 12 months. Use this booklet to help you fill out and file Form 540 or 540A. Computation of the tax will require the two basic financial statements of a business.

Credit from more than one state If you have a credit from more than one state figure the credit separately by completing a separate Schedule S for each state. The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual.

Franchise Tax 405 521-3160. Your annual LLC tax will be due on September 15 2020 15th day of the 4th month Your subsequent annual tax payments will continue to be due on the 15th day of the 4th month of your taxable year. You can check the status of your Form 1040-X Amended US.

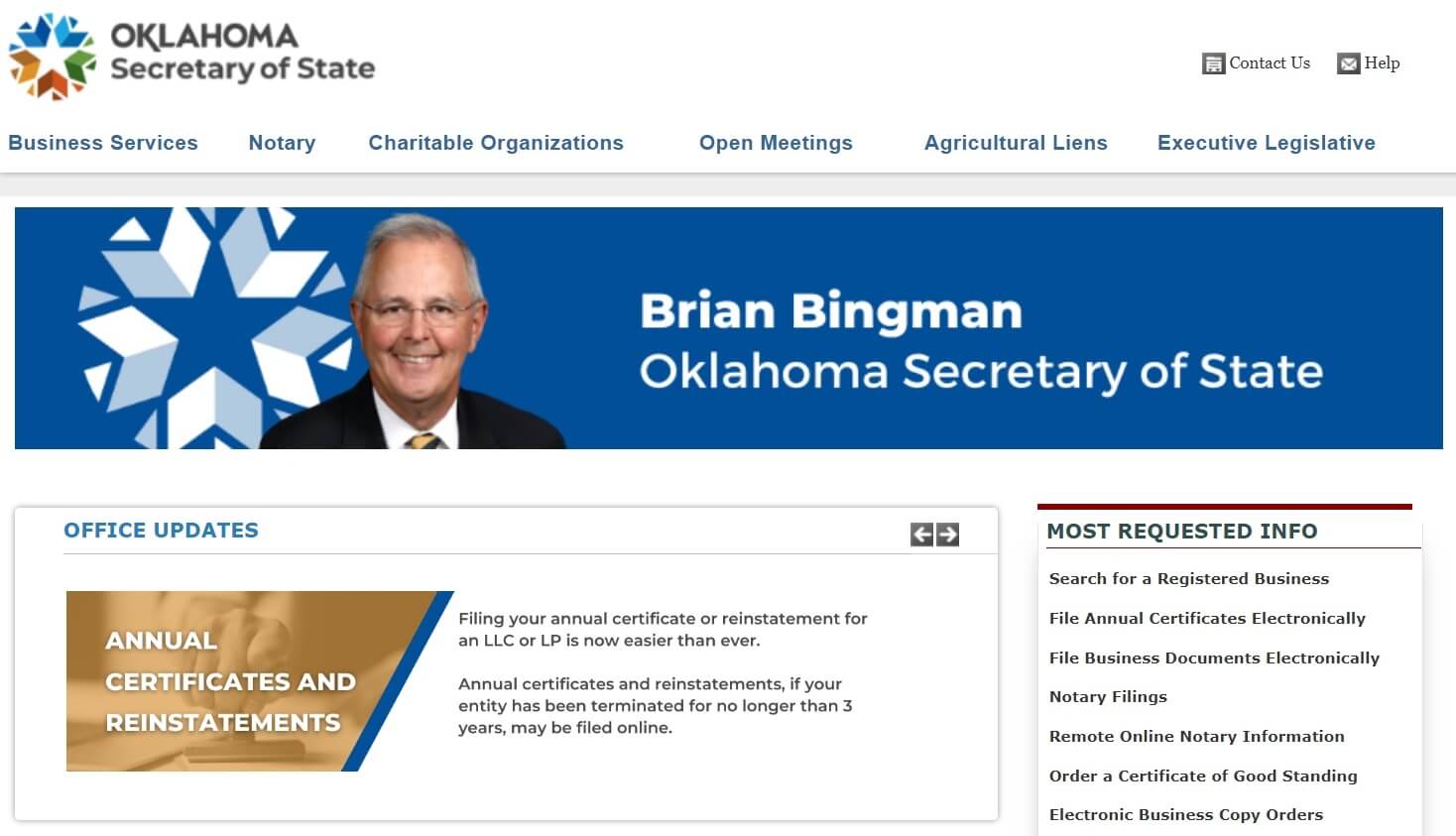

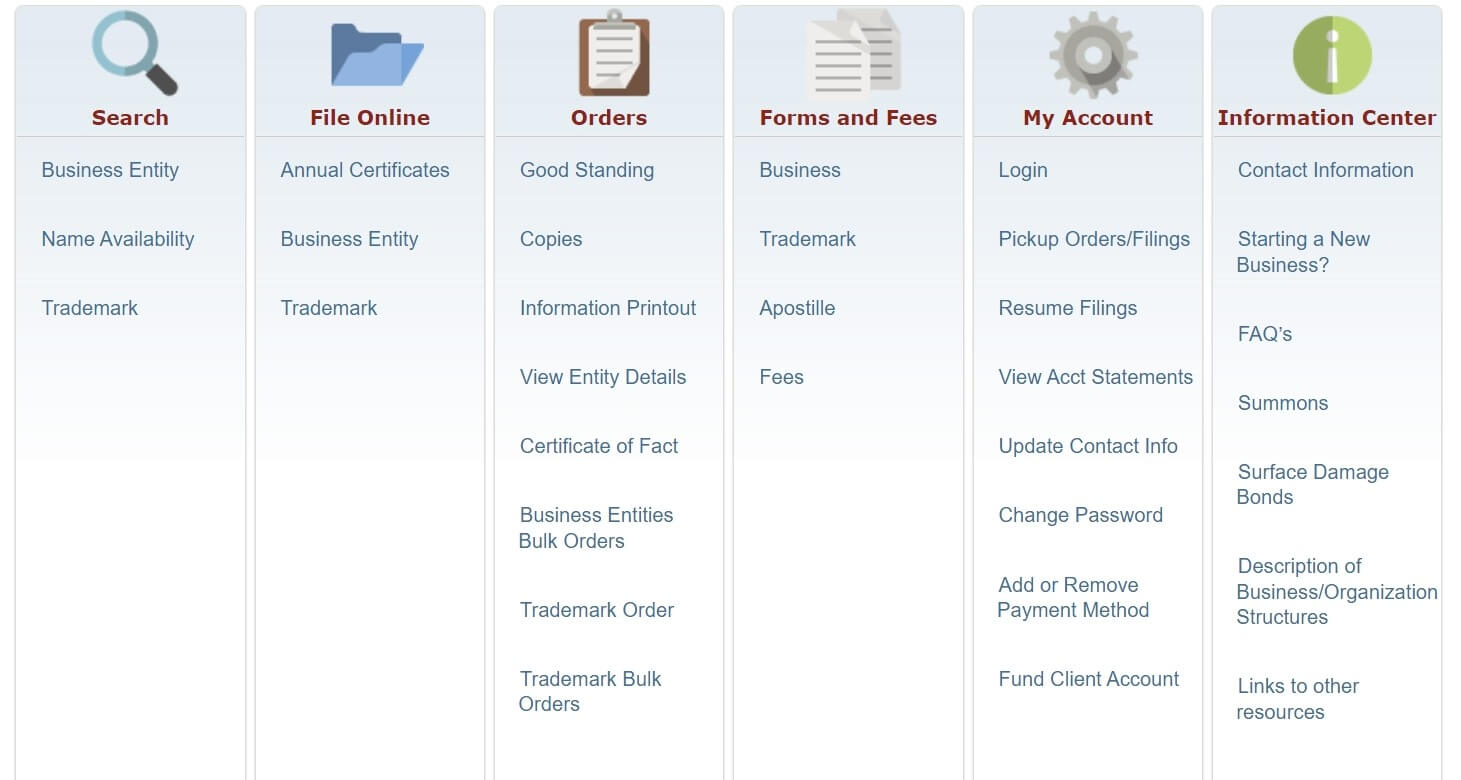

CA Franchise Tax Board Annual LLC Franchise Tax Stmt. The blank PDF application form can be printed off. Oklahoma Tax Commission Division Phone Numbers.

Online tool or by calling the toll-free telephone number 866-464-2050 three weeks after you file your amended return. To get started download the forms and instructions files you need to prepare your 2021 California income tax return. Mississippi Approves Franchise Tax Phasedown Income Tax Cut Tax Foundation May 16.

If the below pre-populated information about your LLC is different please provide updated information here. TaxFormFinder provides printable PDF copies of 96 current Minnesota income tax forms. CO Secretary of State Periodic Report.

Let us help you turn this into an IRS acceptance. Completing and Signing a Franchise Agreement. A Balance Sheet and an Income Statement.

The annual tax payment is due with LLC Tax Voucher FTB 3522. Tax returns may be e-filed without applying for this loan. Individual Income Tax Return using the Wheres My Amended Return.

Pay a franchise tax amount. Both tools are available in English and Spanish and track the status of amended returns for the current year and up to. Oklahoma Tax Commission Taxpayer Assistance Division Post Office Box 26920 Oklahoma City OK 73126-0920 Back to top.

The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. Limited time offer at participating locations. We have included the Regular Due Date alongside the 2022 Due Date for each state in the list as a point of reference.

Choose a Registered Agent. The tax that would have been due for the preceding taxable year based on the taxpayers status and personal exemptions and credits for dependents and facts shown on his return. 11 Key Steps in Opening a Franchise.

Small businesses and statutory employees with expenses of 5000 or less. A registered agent essentially acts as the liaison between an LLC and the state its registered in. Fees for other optional products or product features may apply.

70 0 Good news. If tax is paid to an out-of-state vendor that is not legally due credit is not allowed. You can only submit claims for tax years 1994-2006.

Income Tax Deadlines And Due Dates. Tax Forms Request Unit MS D120 Franchise Tax Board PO Box 307 Rancho Cordova CA 95741-0307 Specific Line Instructions. We would like to show you a description here but the site wont allow us.

To make this election file Form 200-F. Pennsylvania has a flat state income tax of 307 which is administered by the Pennsylvania Department of Revenue.

Oklahoma Form 200 F Fill Online Printable Fillable Blank Pdffiller

Oklahoma State Tax Information Support

Oklahoma Llc Annual Report File An Llc Annual Report In Oklahoma

Oklahoma Partnership Income Tax Return 514

Application For Extension Of Time To File

Special Power Of Attorney Form Elegant Instruction To Fill Oklahoma Special Power Of Attorney

Oklahoma Llc Annual Report File An Llc Annual Report In Oklahoma

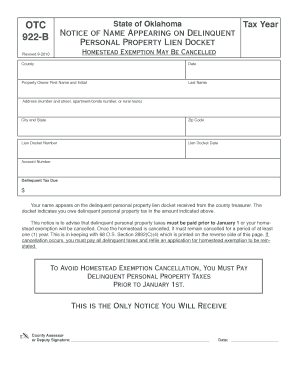

Fillable Online Tax Ok Otc 922 B Oklahoma Tax Commission Tax Ok Fax Email Print Pdffiller

49 Editable Marital Settlement Agreements Word Pdf ᐅ Templatelab Divorce Settlement Agreement Divorce Agreement Divorce Settlement

Godzilla Monster S Inc By Roflo Felorez Deviantart Com On Deviantart Godzilla Godzilla Funny Godzilla Franchise

Stimulus Checks The States Releasing New Payments For May 2022 Marca

Oklahoma Llc Annual Report File An Llc Annual Report In Oklahoma